In the past 20 years, there have been 10 Initiatives, written by conservatives, that have gathered hundreds of thousands of signatures, and won at the polls, only to be overturned by judges due to their failure to comply with various sections of the Washington State Constitution. In fact, in the past 20 years, there has only been one Conservative Initiative that survived a legal challenge (the Parents Rights Initiative in 2025). In this article, we will explain what doomed each of these 10 challenged initiatives and why we must learn from these mistakes if we are to succeed in passing initiatives that become enduring laws over time.

Three steps for an Initiative to become an enduring law

For an Initiative to become a durable law, it needs to

Step #1 Have enough signatures to put it on the ballot.

Step #2 Be approved by a majority of the voters and

Step #3 Comply with the Washington State Constitution in order to survive a legal challenge.

The 3 sections of our state constitution that need to be complied with are:

Article 2, Section 19, of the Washington State Constitution also called the Single Subject Rule, which states: “No bill shall embrace more than one subject, and that shall be expressed in the title.”

Article 2, Section 37 of the Washington Constitution also known as the Full Text rule states: "No act shall ever be revised or amended by mere reference to its title, but the act revised or the section amended shall be set forth at full length."

This means that the full text of the law or section of law being revised or amended by the Initiative must be included in the Initiative submitted to the Secretary of State and must be printed in full on the back of every petition. Failing to include the full text of the amendment can lead to the initiative being overturned.

Article 2, Section 22 of the Washington State Constitution also known as the Simple Majority Rule which states in part: “a majority of the members elected to each house be recorded thereon as voting in its favor.”

An initiative must comply with all three of the above provisions. Violating even one provision renders the entire initiative to be void. In addition, the Initiative can not amend any Constitutional provision.

Problems with 9 Eyman Initiatives

Tim Eyman filed 29 Initiatives in the past 25 years. 13 did not have signatures and never made it to the ballot. Of the 16 that made it to the ballot, only 11 were approved by the voters. Of the 11 approved by the voters, only 2 were accepted without a legal challenge. Of the 9 legally challenged, all 9 were rejected by the Washington State Supreme Court. Thus, Eyman was only able to get 2 of his 29 initiatives durably passed into law. Here we will look at each of the 9 Eyman Initiatives rejected by the Washington Supreme Court to see what went wrong.

The 9 Eyman Initiatives that violated our state constitution included:

1999 Initiative 695, 2000 Initiative 722, 2001 Initiative 747, 2002 Initiative 776, 2007 Initiative 960, 2010 Initiative 1053, 2012 Initiative 1185, 2015 Initiative 1366 and 2018 Initiative 976. We will briefly look at the problems of each of these 9 initiatives in chronological order.

1999 Initiative 695

On March 14, 2000, King County judge Robert Alsdorf issued a detailed 18 page opinion which can be read from this link:

https://caselaw.findlaw.com/court/wa-supreme-court/1023737.html

Here are quotes from this ruling:

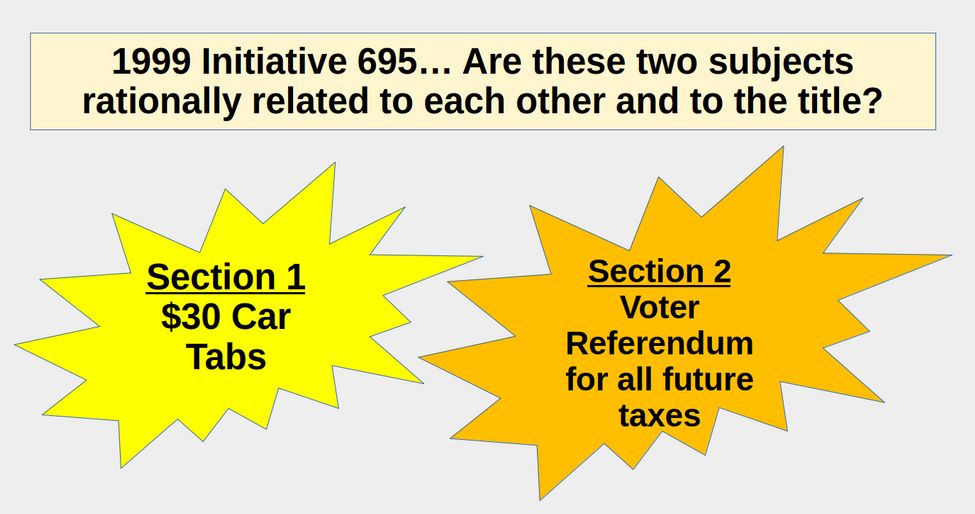

“Initiatives may cover any legislative subject without any limitation as to subject matter except for the prohibition on amending the State Constitution by statute. Section 2 of the Initiative would establish a new Referendum which violates the Four Percent Rule. Article II, Section 1(b) of this State's Constitution explicitly provides that no referendum may be called except upon the signatures of four percent of the population voting for governor in the immediately preceding gubernatorial election: Section 2 of I-695 directly conflicts with this specific provision of the constitution by mandating an up-or-down vote even though there may be no public opposition to or controversy over a particular tax-related action of the agency in question and even without the four percent threshold being met.”

“Section 19 of Article II Single Subject Rule includes “Rational unity.” One must determine if there is rational unity… The courts, however, have not articulated a single test or set of rules for determining if there is rational unity. Three different tests have previously been applied by the courts of this State. Each will be examined here. An affirmative answer to any one will suffice.”

“(i) Is the Proposed Law A Comprehensive Redraft? Perhaps the simplest inquiry is whether a proposed statute or initiative is designed to be a comprehensive rewrite of a particular area of law. In that situation, a single term or concept can cover a wide variety of related topics and establish the requisite rational unity... Initiative 695 does not claim to be an all-encompassing redraft. There is no rational unity under the first test.”

“ii) Does the Law Cover a Single Subject? There is a second possible inquiry, which is largely a matter of logic or common sense. Does one provision naturally imply the other? Is either provision naturally included within or subsumed by the other? In Wash.Toll Bridge Auth. v. State, 49 Wn.2d 520, 523-6 (1956), the Supreme Court held an entire act to be unconstitutional where it was to have involved the following two subjects: a permanent agency to establish and operate toll roads, and the construction of a specific toll road from Tacoma to Everett. See also, State ex rel. Toll Bridge Auth. v. Yelle, 32 Wn.2d 13, 27 (1948) (toll bridges and ferries are not a single subject even though both relate to a transportation system).”

“A law limiting the dollar amount of the State's portion of the car tab does not, standing alone, logically imply or include, let alone require, an overhaul of the manner of imposing or avoiding future tax changes at every other level and for every other function of local, county and State government. Likewise, if one starts the analysis from the point of view of Section 2, passing a law setting new standards for the holding of tax-related referenda does not logically imply, include or require either a $30 or any other particular limit on car tab fees or other specific tax.”

“The Initiative relates to two distinct and specific subjects, first the what of a single tax (the MVET), and second the how of every other future tax, fee and charge by state government… There is no rational unity under the second test.”

“(iii) Do the Law's Subsections Have a Single Purpose? Another uniting principle may be found if there is a common purpose for the various subdivisions of the law. Do they serve a common purpose?...”

“The purpose of the Section 2 referendum requirement is not reasonably read as being limited to that which is necessary to enforce the $30 license tab limitation. It is a far broader change. When the Court accepts the Campaign's reading of the word "tax" under Section 2 of the Initiative, it has no choice but to conclude that Section 2 of the Initiative does far more than prevent the State from making up for MVET reductions. Reading Section 2 in the broad manner sought by the Campaign prevents it from having rational unity with Section 1 and 3's new and specific limit on MVET funding. There is no rational unity under the third test. “

“When There Is No Rational Unity, Courts Cannot Arbitrarily Pick One Portion of the Law to Be Effective.”

“The inclusion of a voter referendum requirement in what everybody including the Campaign referred to simply as the $30 License Tab Initiative was fatal to the Initiative's constitutionality under the first clause of Article II, Section 19. If the Campaign had proposed two separate initiatives, the universal tax referendum proposal that is currently known as Section 2 of Initiative 695 would have had no impact on the $30 license tab limit under the single subject rule of Article II, Section 19. The Campaign sought too much for a single initiative.”

“This next challenge to the Initiative arises under the second clause of Article II, Section 19 of the State Constitution: No bill shall embrace more than one subject, and that shall be expressed in the title. That second clause requires that the subject of the law be directly and clearly expressed in its title, so that citizens will know what they are voting for… Neither the official Ballot Title nor the Initiative's own wordier title gave the public fair notice that the Initiative's provisions were designed to establish universal referenda on all fees and charges and not just taxes. Using the Campaign's own definition, the Court must necessarily conclude that the subject of the initiative has not been properly set forth in its title. As a result, Section 2 of I-695 violates Article II, Section 19 of the Constitution and is void. “

The court ruled that Section 2 was not only a separate subject, but that it violated the Washington Constitution rule that any referendum requires petition signatures from 4% of the voters. Article II, Section 1(b)

“Does Section 3 of the Initiative Include Subjects Not Identified in the Ballot Title?”

““Section 3 of the Initiative lists a series of laws that are to be repealed. These Acts and portions of Acts were listed by RCW section number only... without the text of such sections being printed in the Initiative's text, there is no reasonable means by which a voter could readily understand those references or know specifically what is affected, modified or repealed… Those defects are constitutional defects, rendering unconstitutional the proposed repeal of the sections cited above…A Law Enacted by Initiative Must Set Forth the Text of All Laws that are to be Revised. Article II, Section 37 requires that the full text of any act or section being amended be set forth in full in order to avoid any confusion or ambiguity as to both the meaning of the new law and its impact on existing law, to identify the extent of revision contemplated or achieved by the amendment.

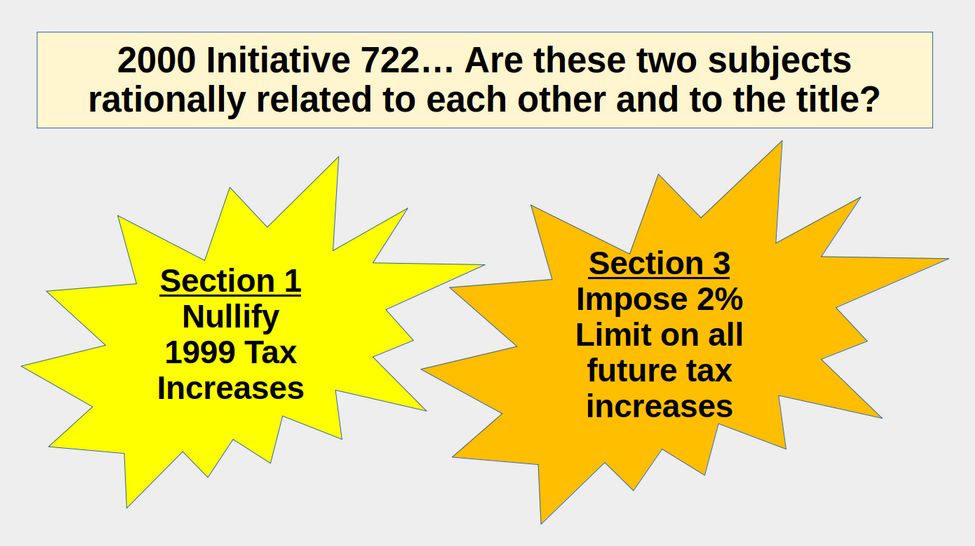

2000 Initiative 722

The next Eyman initiative to pass was 2000 Initiative 722 (I-722): “Shall certain 1999 tax and fee increases be nullified, vehicles exempted from property taxes, and property tax increases (except new construction) limited to 2% annually? Initiative 722 was challenged in a case called City of Burien v. Kiga. Here is a link to this Washington Supreme Court decision:

https://law.justia.com/cases/washington/supreme-court/2001/70830-4-1.html

Here are quotes from this 2001 decision:

“Judge Pomeroy ruled I-722 unconstitutional on four separate constitutional grounds… We begin our analysis by determining whether I-722 violates the single subject clause of Wash. Const. art. II, § 19… In making the determination of whether an initiative violates the single subject clause, we first look to the ballot title to determine whether it is general or restrictive… I-722 contains a general title. “

“Once an initiative ballot title is identified as being general, we look to the body of the initiative to determine whether a rational unity among the matters addressed in the initiative exists. An initiative can embrace several incidental subjects or subdivisions and not violate article II, section 19, so long as they are related. In order to survive, however, rational unity must exist among all matters included within the measure and the general topic expressed in the title.”

“the existence of rational unity or not is determined by whether the matters within the body of the initiative are germane to the general title and whether they are germane to one another.. we find I-722 also embraces at least two purposes. First, section (1) seeks to nullify various 1999 tax increases and proposes a onetime refund of those taxes. Second, sections (3) through (7) seek to change the method of assessing property taxes, culminating in a 2 percent cap for property tax increases...We find the subjects in I-722 are not germane to one another… The kind of logrolling of unrelated measures embodied in I-722 violates the fundamental principle embedded in article II, section 19 and is unconstitutional. “

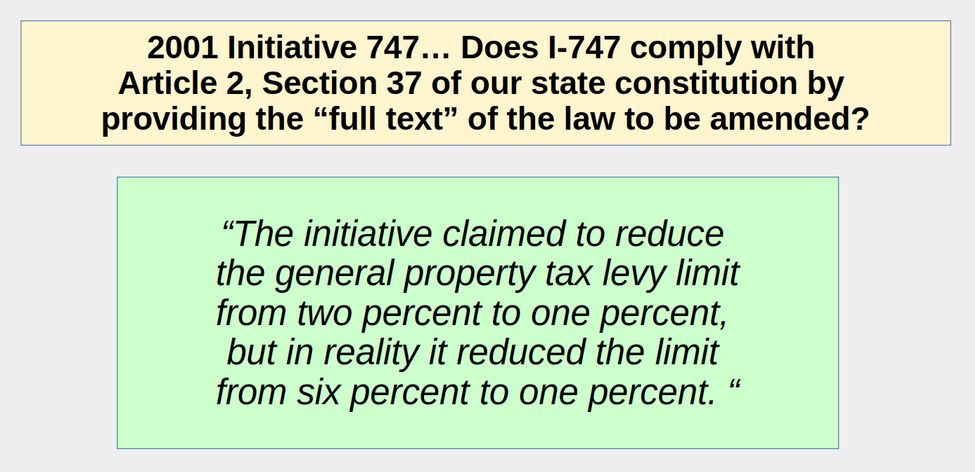

2001 Initiative 747

The next Eyman initiative to pass was 2001 Initiative 747 (I-747) which placed a one percent limit on property tax increases. On November 6, 2001, the voters approved I-747. The Washington Supreme Court ruled the Initiative unconstitutional in the case called Washington Citizens Action of Washington v. State. Here is a link to this case:

https://law.justia.com/cases/washington/supreme-court/2007/78844-8-1.html

Here are quotes from this opinion:

“Article II, section 37 of the Washington Constitution *488 requires that amendatory laws set forth at full length the law to be amended… While the challengers also assert that I-747 violated article II, section 19 subject in title requirement, we need not address that argument in this case.”

“The initiative claimed to reduce the general property tax levy limit from two percent to one percent, but in reality it reduced the limit from six percent to one percent. “

The law being amended was RCW 84.55 RCW LIMITATIONS UPON REGULAR PROPERTY TAXES which states in part:

1997 law stated: "It is the intent of sections 201 through 207 of this act to lower the one hundred six percent limit while still allowing taxing districts to raise revenues in excess of the limit if approved by a majority of the voters.”

A later law changed this to: ‘Upon a finding of substantial need, the legislative authority of a taxing district other than the state may provide for the use of a limit factor under this chapter of one hundred one percent or less. In districts with legislative authorities of four members or less, two-thirds of the members must approve an ordinance or resolution under this section. In districts with more than four members, a majority plus one vote must approve an ordinance or resolution under this section. The new limit factor shall be effective for taxes collected in the following year only.’

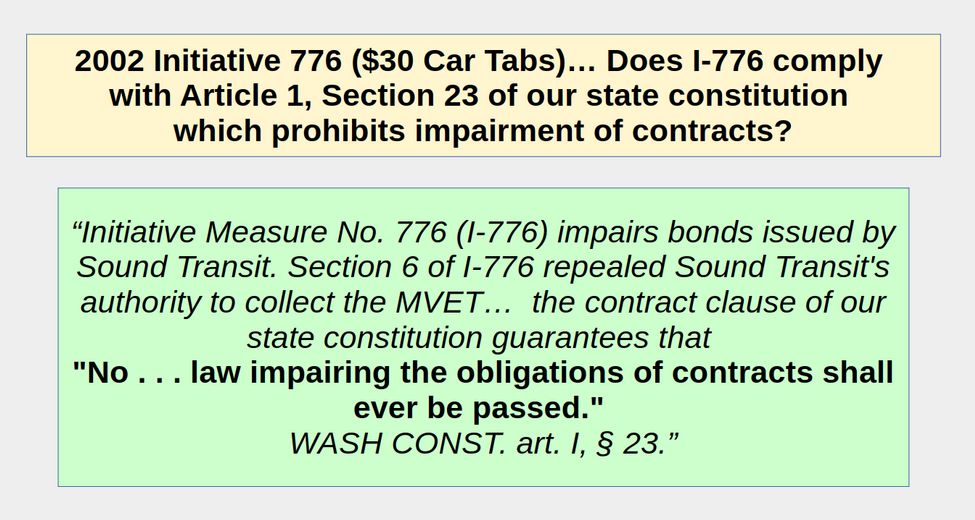

2002 Initiative 776 Son of $30 car tabs

The next Eyman initiative to pass was 2002 Initiative 776 (I-776) which lowered car tabs to $30 and repealed other transportation fees. The Washington Supreme Court ruled the Initiative unconstitutional in the 2003 case called Pierce County. v. State. Here is a link to this ruling:

https://law.justia.com/cases/washington/supreme-court/2003/73607-3-1.html

Here are quotes from this ruling:

“Having determined that I-776 has only one subject (limiting license tab fees on cars and light trucks), this court must consider the second requirement of article II, section 19 that the subject be expressed in the ballot title… To be constitutionally adequate, "the title need not be an index to the contents, nor must it provide details of the measure."

“By statute, the ballot title for an initiative to the people has three parts: "(a) A statement of the subject of the measure; (b) a concise description of the measure; and (c) a question in the form prescribed in this section for the ballot measure in question."

“Moreover, the statute puts a 10-word limit on the "statement of the subject" and a 30-word limit on the "concise description."

The Washington Supreme Court found the Initiative complied with the Single Subject rule. But on remand, another issue came up leading to 2006 Pierce County II. v. State. Here is a link to this case:

https://law.justia.com/cases/washington/supreme-court/2006/76534-1-1.html

Here are quotes from this case: “The issue in this case is whether Initiative Measure No. 776 (I-776) impairs bonds issued by Sound Transit. Section 6 of I-776 repealed Sound Transit's authority to collect the MVET… the contract clause of our state constitution guarantees that "No . . . law impairing the obligations of contracts shall ever be passed." WASH CONST. art. I, § 23.”

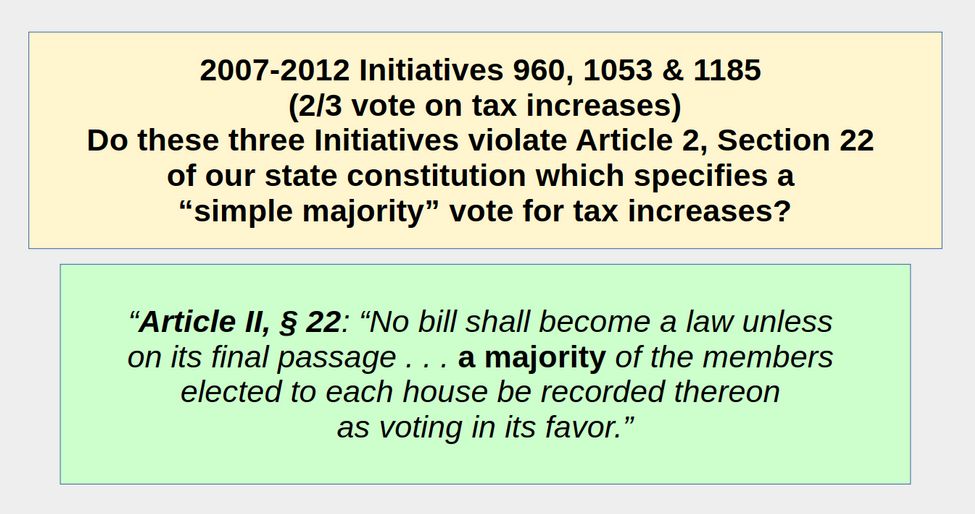

2007 -2012 Initiatives 960, 1053 and 1185 Super-majority tax increases

The next Eyman initiatives to pass were 2007 to 2012 Initiative 960 (I-960), 1053 (I-1053), and 1185 (I-1185) — all three addressed the same super-majority requirement for tax increases, and all three were struck down in League of Education Voters v. State. The key constitutional issue was whether the super-majority requirement was at odds with Article II, § 22: “No bill shall become a law unless on its final passage . . . a majority of the members elected to each house be recorded thereon as voting in its favor.

Here is a link to this decision.

https://cases.justia.com/washington/supreme-court/87425-5-1.pdf?ts=1396151908

Here is a quote from this decision: “The Super-majority Requirement violates article II, section 22 by requiring certain legislation to receive a two-thirds vote.”

In plain English, one can not amend the Constitution through an Initiative. The only way to amend the Constitution is through a Constitutional Amendment.

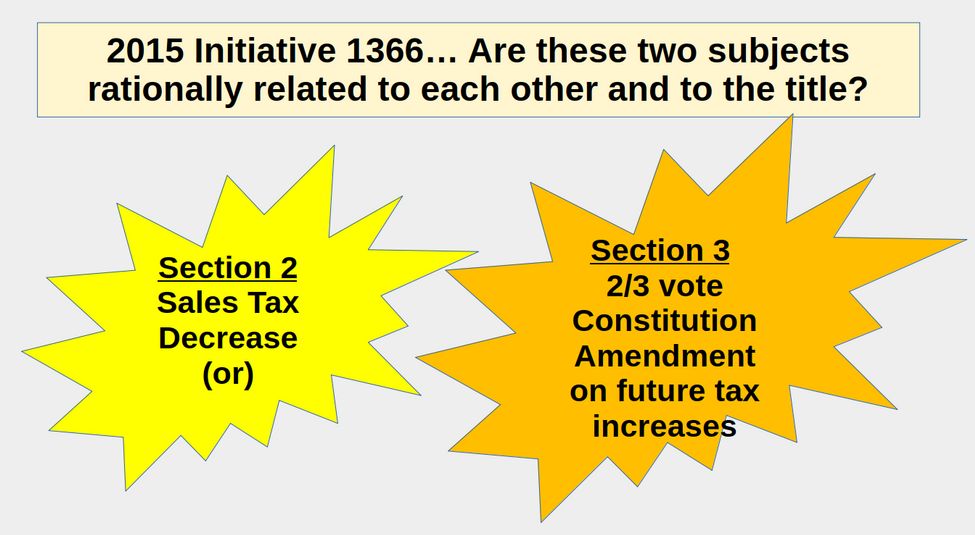

2015 Initiative 1366

Initiative 1366 attempted to blackmail the legislature by decreasing the sales tax rate unless the legislature refers to voters a constitutional amendment requiring two-thirds legislative approval or voter approval to raise taxes, and legislative approval for fee increases.” The measure passed with 52% of the vote. It was then challenged in King County, where Judge William Downing held that it violated Article II, § 19.

Judge Downing wrote, “It is impossible to determine how many people voted for this initiative because they desired adoption of the constitutional amendment at its heart and how many voted for it because they desired the short-term relief of the immediate reduction in the sales tax. The Washington Supreme Court agreed in the case called Lee v. State.

Here is a link to this 27 page decision:

https://cases.justia.com/washington/supreme-court/2016-92708-1.pdf?ts=1464275851

Here are quotes from this decision:

“This is the kind of log rolling of unrelated measures article II, section 19 of the Washington State Constitution was adopted to prevent… A reduction to the sales tax rate is unrelated to both a constitutional amendment, which would impact future legislatures, and to the way that future taxes and fees are approved… In its essence, I-1366 mirrors I-695 and I-722.”

“The key inquiry is whether the subjects are so unrelated that "it is impossible for the court to assess whether either subject would have received majority support if voted on separately."

“I-1366 contains two unrelated operative provisions but only one will go into effect. The fact that the initiative does not enact both provisions does not save it from violating article II, section 19. It is still impossible to determine how many people voted for one provision and how many for the other.”

“A constitutional amendment may not be proposed or enacted through initiative… "an initiative must propose the enactment of a law and not the amendment of the constitution."

“A reduction in the current sales tax rate is not necessary to implement a constitutional amendment or a change to the method for approving all future taxes and fees; quite the opposite, in fact, since one subject actually voids implementation of the other subject. “

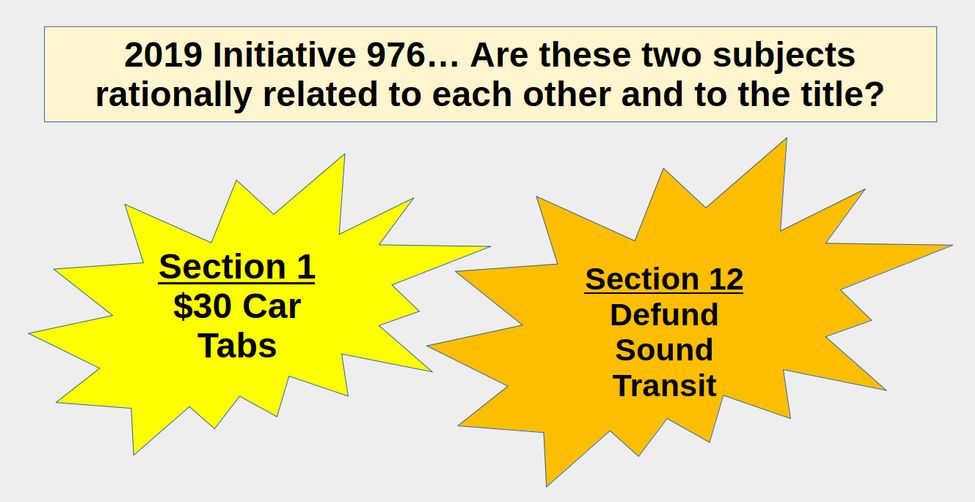

2018 Initiative 976

Eyman presented $30 car tabs issue one more time with 2019 Initiative 976 (I-976). The Initiative passed but was challenged in the case called Garfield County v. State Here is a link to this 36 page decision:

https://www.courts.wa.gov/opinions/pdf/983208.PDF

Here are quotes from this decision with the legal citations omitted:

“Initiative Measure 976 (I-976) contains more than one subject, and its subject is not accurately expressed in its title. Accordingly, it is unconstitutional.”

“In 1996, voters in the counties of King, Pierce, and Snohomish approved a transportation proposal and a funding plan secured by local taxes and fees, including local motor vehicle excise taxes. Based on that vote, Sound Transit issued bonds secured by these local funding sources.”

“In our state, the people have a constitutional power to propose and pass legislation. WASH. CONST . art. II, § 1(a). When acting in this legislative capacity, the people are subject to the constraints laid out in our constitution… Under our constitution, “no bill shall embrace more than one subject, and that shall be expressed in the title.” WASH. CONST . art. II, § 19.”

Article II, section 19 serves three purposes. First, it prevents “logrolling,” where a popular measure is attached to an unpopular one to ensure passage of the unpopular measure. Second, it “enlightens the members of the legislature [and voters considering initiatives] against provisions in bills of which the titles give no intimation. Third, it informs the public… about the subjects being considered. Initiatives that contain more than one subject are void in their entirety.”

“We agree that section 12, which requires Sound Transit to retire, defease, or refinance bonds, is not germane to limiting vehicle taxes and fees, and the provisions of the initiative that carry out that subject. Thus, section 12 is an unconstitutional second subject… Section 12 is a specific directive to retire, defease, or refinance existing bonds, if possible. This is a separate subject from “limiting vehicle taxes and fees.” Accordingly, I-976 violates article II, section 19’s single subject rule.”

“We have regularly found two subjects in violation of article II, section 19 when a measure both contained a one-time required action and a broader systematic change in the law… We also found two subjects when an initiative set car tabs at $30 and required voter approval for tax increases…”

“The initiative violates the subject-in-title rule because it is deceptive and misleading since the average informed lay voter would conclude voter approved taxes – such as those used to fund local transportation projects across our state – would remain… We hold that that I-976 violates article II, section 19 because it contains multiple subjects and an inaccurate ballot title.”

Summary of Supreme Court 976 Ruling

In plain English, the Washington Supreme Court concluded that the requirement in Section 12 that Sound Transit retire its Transportation bonds was not related to the requirements in the rest of the Initiative to reduce car tabs fees. This was similar to past Eyman Initiatives where they found he combined a popular issue like reducing specific taxes with an unrelated – and even unconstitutional issue – like amending the constitution to require a two thirds vote on all tax increases. In political circles, this strategy is called “log rolling” which is the main thing that the Single Subject rule in our State Constitution is intended to prevent. The solution to writing a “Constitutionally sound” Initiative is to limit the Initiative to the single subject of $30 car tabs – and simply not include Section 12. If you want to change the way Sound Transit is financed, then do that in a separate Initiative.

Eyman disagrees with the Supreme Court 976 Ruling

Sadly, instead of complying with our State Constitution by following the Single Subject Rule, Eyman has spent the past 6 years “protesting” the Supreme Court decision by refusing to renew his car tabs. Here are quotes from a fund raising email Eyman sent to his supporters on July 3, 2025:

“It's been 6 years and I refuse to renew. For me, it's worth it. Here's why: We, the people, passed a law (for the 3rd time!) that made vehicle taxes and fees above $30 unlawful. We voted to have that law take effect on December 5, 2019. But Jay Inslee blocked it, saying voters were "confused." The initiative was crystal clear. Every "yes voter" and every "no voter" knew exactly what it did. But WA's governmental system refused to respect our vote. When they did, they took our democracy away from us.”

“This is about an election and a decision made by the people. It’s about the basic principle of one person, one vote. There was a campaign, there was an election, there was a vote. 1.05 million voters voted yes, far fewer voted no. The people – sovereign citizens – decided. In a democratic vote, the side that receives the most votes wins… But here in our state, that principle was corrupted. They've ordered us to comply — we should not. If we do — if we roll over and pay government charges that we voted to make unlawful (for the 3rd time), then we will have lost much more than an unlikely ticket for expired tabs. This is a crisis that demands action, not subservience. We refuse to comply, to cooperate, to bow, to grovel for our right to have our vote count.”

Are Eyman’s Complaints Accurate?

To me, Eyman appears to be stubbornly and repeatedly ignoring our State Constitution. He writes Initiatives that make all kinds of popular promises – which is why people often vote in favor of his Initiatives. But his promises are ultimately contrary to our State Constitution. He then gets mad when the Supreme Court rules in favor of upholding our State Constitution. It is true that he tried three times to pass $30 car tabs. But each time, he wrote the Initiatives in a way that violated our State Constitution. Instead of learning from his past mistakes – by more carefully writing his Initiatives in a way that complies with the Single Subject Rule – he just keeps making the same mistake over and over again – and expecting a different result.

Having now read all of the Supreme Court decisions overturning the Eyman Initiatives, I think it is not accurate to claim that the Supreme Court argued that the “voters were confused.” Instead, they based their rulings on the fact that Eyman repeatedly included unrelated subjects in all of his Initiatives that they overturned.

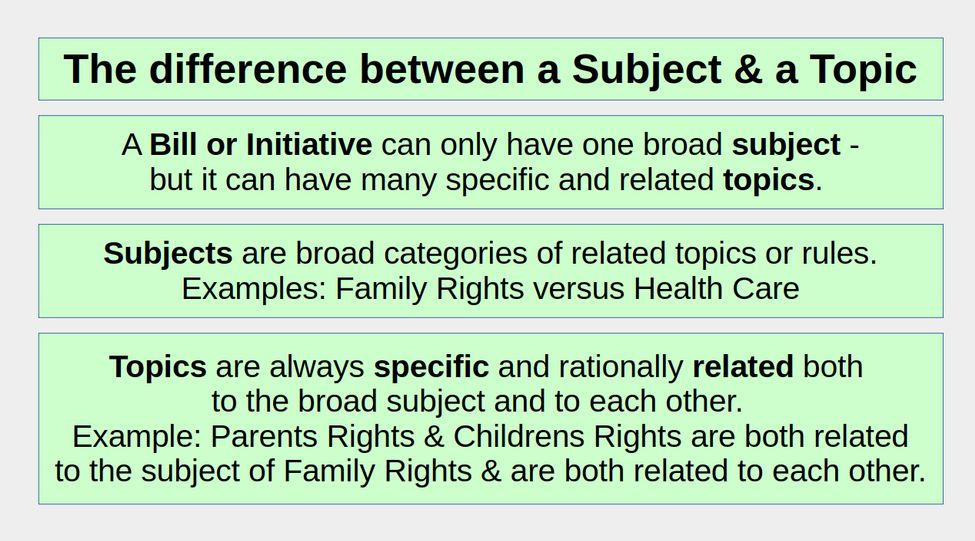

The confusion has to do with the difference between a “subject” and a “topic.” Bills or Initiatives can only include one broad Subject, such as the subject tax reform. But as long as the subject is broadly stated, it can include many topics -provided that the topics are all related to the subject and are all rationally related to each other.

Summary of Rulings on the Single Subject Rule

Even if Eyman refuses to learn from his past mistakes, at the very least, the rest of us should pay close attention to what the Supreme Court says about complying with the Single Subject Rule. Below is a summary of their position on this subject.

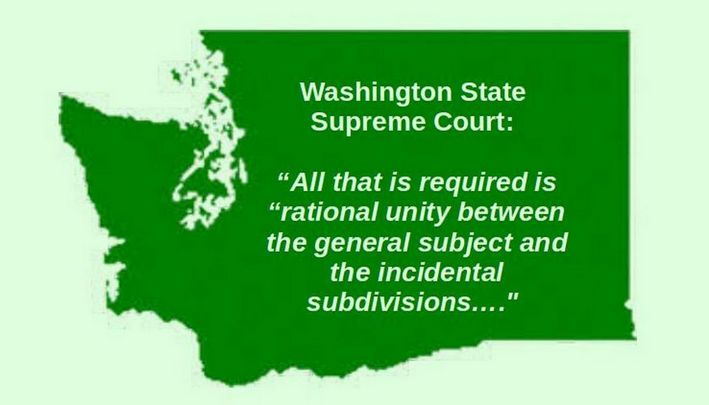

“This court cannot interpret the initiative in such a manner that it deprives the people of acting in their legislative capacity. Legislation should be construed to preserve its constitutionality where possible… This constitutional provision (the single subject rule) is liberally construed in favor of upholding legislation… “

“Our single subject analysis is framed differently depending on whether the ballot title is general or restrictive. The parties agree that I-976 has a general title. In such cases, all that is required is “‘rational unity between the general subject and the incidental subdivisions…. The existence of rational unity is determined by whether the matters within the body of the initiative are germane to the general title and whether they are germane to one another.”

“The subject-in-title rule does not require absolute clarity. Ballot titles need not be “‘an index to its contents; nor is the title expected to give the details contained in the bill.’” . A title complies with the constitution if it provides notice leading to inquiry into the body of the act. that terms are broadened in the body of the act.”

In plain English, the Washington Supreme Court divided Initiatives and legislative bills into two categories. One category is bills with specific titles requiring narrowly defined specific actions. The second category is bills with broad general titles which provide a comprehensive set of policy changes. In addition, if the content of the bill or initiative broadens or clarifies terms, the title of the bill or initiative must provide notice in the title that inquiring minds should look in the bill to learn how these terms have been broadened or clarified.

Therefore an Initiative that:

#1 has a broad title

#2 includes subjects related to that title

#3 includes a notice that it broadens and clarifies terms will comply with the single subject rule and

#4 has a title that is not deceptive or misleading

– will be upheld as complying with the single subject rule .

2024 Natural Gas Initiative 2066

The Natural Gas Initiative was overturned in part because it did not include the full text of several state laws it altered. On May 9, 2025, a King County court granted Summary Judgement to Climate Solutions. On May 27, the Washington State Attorney General and BIAW filed a 51 page appeal of the ruling to the Washington State Supreme Court. You can download the appeal at this link:

https://cdn.prod.website-files.com/65565b1bdfa204c7e86303ad/68363fff17c2e100b037975c_5.27.25%20Intervenor-Defendants%27%20Notice%20of%20Appeal%20to%20Supreme%20Court.pdf

The BIAW Appeal includes the King County Court’s May 9 Order as well as the full text of the Initiative. Before quoting from the May 9 Order, I want to make a few comments about it. I have routinely criticized King County judges for making political and even downright unconstitutional decisions. But having read several Supreme Court decisions on the Single Subject Rule as well as well as the text of I 1066, I believe that this King County judge is at least partially right and will likely be upheld by the Washington Supreme Court. In short, I think that I-1066 was not well written. We should read the following comments carefully and make sure we comply with these rules when writing Initiatives in the future.

Here are quotes from the King County May 9 decision:

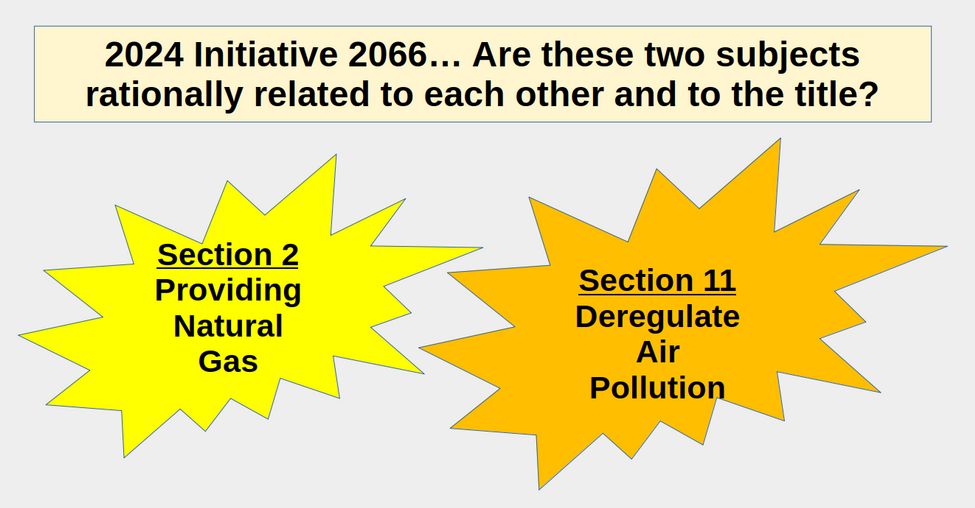

“The following subjects are among the many contained in the 20-plus pages of Initiative 2066: (1) providing natural gas to homes and businesses, (2) limiting the authority of agencies to control air pollution, and (3) changing building energy efficiency standards. Because these different subjects are not related to each other, I-2066 is unconstitutional under Section 19.”

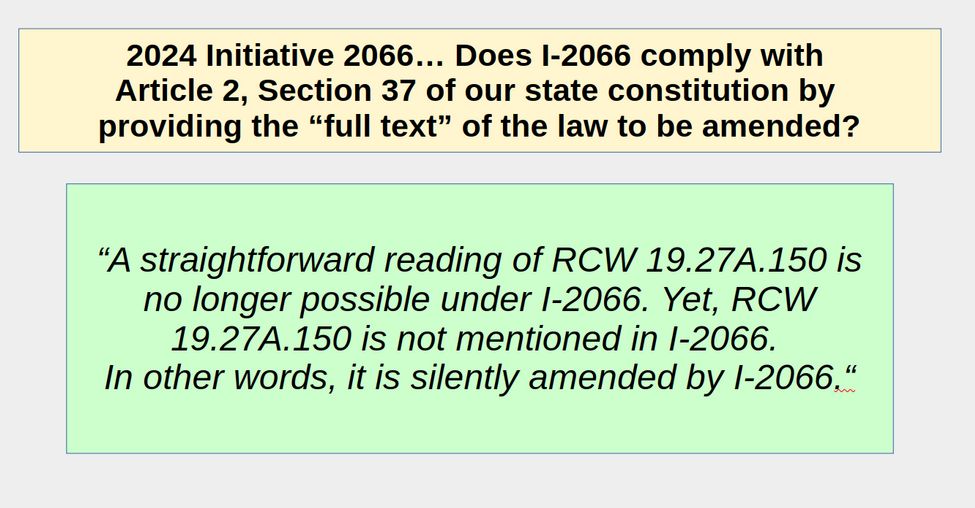

“The Washington Constitution, Article II, Section 37, provides: “No act shall ever be revised or amended by mere reference to its title, but the act revised or the section amended shall be set forth at full length.” The Washington Supreme Court has held that under Section 37, an initiative must directly set forth the laws that the initiative changes in order for the initiative to be constitutional. In other words, the initiative cannot silently amend state laws without warning the voter. Here, Initiative 2066 silently amends a host of state laws.”

“Under current law: (1) the Department of Commerce makes energy efficiency recommendations to the Building Code Council; (2) energy conservation in the design of public facilities is required; (3) low cost and long term financing, and other incentives, are available for commercial property owners; and (4) local governments are required to develop comprehensive plans that reduce greenhouse gas emissions. These laws are all silently undone by Initiative 2066. Initiative 2066 is unconstitutional because it silently amends state laws without notice to the voter.”

“Plaintiffs moved for summary judgment arguing that I-2066 is unconstitutional on three separate grounds: (1) that it violates the “single subject” clause of Wash. Const. Art. I, § 19, by including sections that are not “germane” to one another; (2) that it violates the “subject in title” rule of Wash. Const. Art. IJ, § 19, by not properly conveying the essence of the measure through the title; and (3) that it violates Wash. Const. Art. II, § 37 by silently amending other laws.”

“In deciding whether an initiative violates the single subject clause, a court must first determine if the ballot title is general or restrictive. Here, the parties agree that I-2066 has a general title. After establishing that the initiative has a general title, the Court must determine the “general subject” of the initiative. This is a difficult task in the present case because the 20-plus pages of the initiative are so broad and free-ranging that it is extremely difficult to say with precision what the general subject is. That said, the Court concludes that the general subject is both protecting and promoting access to natural gas, and regulating access to gas and electrification services.”

“When an initiative has a general title, such as here, it “may embrace several incidental subjects so long as there is a rational unity between the operative provisions themselves as well as the general subject.”

“An initiative can embrace several incidental subjects and not violate the single subject clause if the underlying matters are related through “rational unity.” Rational unity does not exist when the subjects are so unrelated that the court cannot tell which subject was favored by the voters. Another indicator of rational unity is whether the subjects of the legislation have previously been considered together in the same legislative act. “

“The Washington Supreme Court in ATU, supra, declared unconstitutional Initiative 695, which set license tab fees at a specific amount and provided a continuing method of approving future tax increases. The Court found that the subjects were not germane to each other, noting that neither purpose was necessary for the implementation of the other. I-2066, however, is not a broad omnibus bill that comprehensively “addresses a larger subject area.”

I-2066’s various provisions — including those limiting the authority of the government to regulate natural gas air pollutants and amending building efficiency standards and decarbonization requirements (which apply to energy sources other than natural gas) — do not relate to each other... It is abundantly clear that I-2066’s multiple subjects are not germane to each other. Sections 2 and 3 of I-2066 require certain utility companies, cities, and towns to furnish natural gas to eligible customers. By contrast, Section 11 of I-2066 provides that air pollution control agencies under the Clean Air Act may not “prohibit, penalize, or discourage the use of gas for any form of heating, or for uses related to any appliance or equipment, in any building.” These provisions are unrelated and not germane to one another. A voter may very well want to have access to natural gas, but at the same time, want the government to regulate natural gas air pollution. In addition, limiting the authority of air pollution control agencies is not necessary to requiring the provision of natural gas by local governments. Furthermore, there is no legislative precedent for addressing all of the subjects covered by I-2066 in a single piece of legislation. There is “no legislatively recognized connection” between the various subjects at issue in the initiative.”

“In addition to internal rational unity, an initiative’s subjects must also be germane to its “general title,” also referred to as the “general subject” of the initiative. “

“The Court has determined that I-2066’s general subject is both protecting and promoting access to natural gas, and regulating access to gas and electrification services.”

“As with the previous analysis, I-2066’s myriad subjects are not germane to even this expansive general subject. For example, I-2066’s changes to the Decarbonization Act are not germane to requiring that natural gas be provided to eligible customers.”

“The fact that the initiative would undermine Washington’s Clean Air Act and prohibit local authorities from taking measures to reduce greenhouse gases also is not germane to the general subject of the initiative. “

“The purpose of the subject-in-title rule of Art. II, § 19 is “to notify members of the legislature and the public of the subject matter of a measure.” Courts have recognized the particular importance of this requirement for initiatives, noting that “often voters will not reach the text of a measure or the explanatory statement, but may instead cast their votes based upon the ballot title.”

“The title of an initiative does not have to provide a “detailed index” to the initiative’s contents. A measure’s title can be broad and general but “the material representations in the title must not be misleading or false, which would thwart the underlying purpose of ensuring that no person may be deceived as to what matters are being legislated upon. A title which is misleading or false is not constitutionally framed.”

“Any objections to the title “must be grave and the conflict between it and the constitution palpable” before a court will hold an act unconstitutional on this basis. A title must give notice “that would lead to an inquiry into the body of the act, or indicate to an inquiring mind the scope and purpose of the law. The words in a title are construed in their ordinary manner (unless specified otherwise in the title). “

“The question before the court is whether I-2066’s ballot title gives the public proper notice of its contents. I-2066’s title does not apprise a reasonably informed voter of the initiative’s contents. For example, the title does not provide sufficient notice that a voter would inquire whether it limits the ability of agencies to regulate air pollution. Nor does it indicate that I-2066 seeks to roll back energy efficiency standards for buildings (affecting all fossil fuels, not just natural gas). “

“The title does not suggest that building code standards pertaining to gas appliances, particularly appliances other than natural gas, may be impacted. Because I-2066’s title does not mention these subjects, nor prompt inquiry into them, it violates the subject-in-title requirement of article II, section 19 of the Washington Constitution.”

“Article II, § 37 provides that, “No act shall ever be revised or amended by mere reference to its title, but the act revised or the section amended shall be set forth at full length.” The purpose of Art. II, § 37 is to disclose the effect of new legislation and its impact on existing laws.”

“An act is “not complete” if it “refers to a prior statute which is changed but not repealed by the new act,” because then people are “required to read both statutes before the full declaration of the legislative will on the subject can be ascertained.”

“If the legislation is complete, the fact that other statutes will be modified or repealed can be determined from the act itself without having to specify which laws would be impacted. It is permissible for an initiative to have undeclared incidental effects on other statutes, provided the other statutes are not modified by implication. “

“I-2066 is not a complete act because its effects cannot be determined just by reading the initiative. (Also) I-2066 renders a straightforward reading of many existing laws erroneous or untenable. A straightforward reading of RCW 19.27A.150 is no longer possible under I-2066. Yet, RCW 19.27A.150 is not mentioned in I-2066. In other words, it is silently amended by I-2066.

“Chapter 39.35 RCW is not mentioned in I-2066 and is therefore silently amended by it. I-2066 does not reference chapter 36.165 RCW.”

“A straightforward interpretation of the Growth Management Act RCW 36.70A.070(9) is no longer possible under I-2066.”

“RCW 80.28.460 conflicts with Section 4 of I-2066. Although I-2066 references a different subsection of chapter 80.28 RCW, it does not address this one. I-2066 also creates a conflict among provisions of the Clean Air Act, Chapter 70A.15 RCW ,which renders a straightforward understanding of this law erroneous. In sum, I-2066 violates Art. IT, § 37 by silently amending existing state laws.”

Constitutional Problems with the new Heywood Initiatives to the 2026 Legislature

Brian Heywood has recently filed several initiatives to the legislature. These can be viewed on this page:

https://apps.sos.wa.gov/elections/initiatives/initiatives.aspx?y=2025&t=l

Constitutional violations of his Repeal of House Bill 1296

On June 3, 2025, Heywood submitted the following 5 page Initiative Measure No. IL26-109 called “Restore the Parents Bill of Rights.”

Ballot Title

Initiative Measure No. IL26-109 concerns parental rights relating to their children in public school. This measure would repeal amendments to a statute listing certain rights of parents and guardians of public-school children and re-enact the law as it was originally enacted by Initiative to the Legislature 2081.

Ballot Measure Summary

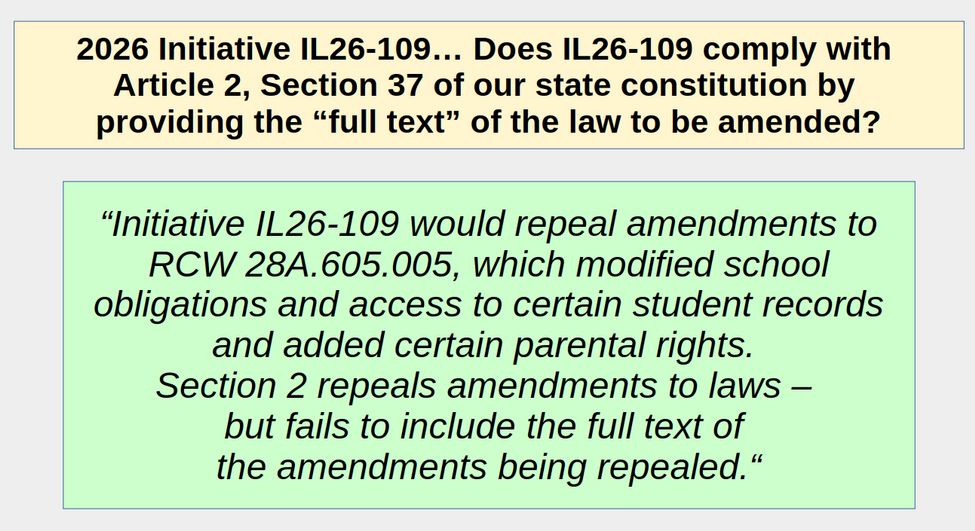

This measure would repeal RCW 28A.605.005 and re-enact the law as it was enacted in Initiative to the Legislature 2081. The re-enacted law would list certain rights of parents and guardians of public-school children, including rights to review materials and student records, receive certain notifications, and opt students out of certain activities. Initiative IL26-109 would repeal amendments to RCW 28A605.005 , which modified school obligations and access to certain student records and added certain parental rights.

Section 2 of the bill repeals amendments to laws – but fails to include the full text of the amendments being repealed. Article 2, Section 37 of the Washington constitution also known as the Full Text rule states: "No act shall ever be revised or amended by mere reference to its title, but the act revised or the section amended shall be set forth at full length."

This means that the full text of the law being repealed or amended by the Initiative must be included in the Initiative submitted to the Secretary of State and must be printed in full on the back of every petition. Failing to include the full text of the amendment can lead to the initiative being overturned.

NOTE: Heywood withdrew this Initiative on July 11, 2025.

On June 2, 2025, Heywood submitted IL26-638 aka Fairness in Girls Sports.

Ballot Title: Initiative Measure No. IL26-638 concerns participation in athletics at K-12 schools. This measure would prohibit students it defines as “biologically male” from competing in certain school athletic activities intended for female students only. It would require verification of biological sex by students’ healthcare providers.

Ballot Measure Summary: This measure would require policies prohibiting students it defines as “biologically male” from competing with or against female students in certain inter-school athletic activities that are intended for female students only. Students who choose to participate in such activities must provide a statement from the student’s healthcare provider verifying the student’s biological sex, based on reproductive anatomy, genetic makeup, or normal endogenously produced testosterone levels. These requirements would apply to individual or team athletic competitions.

Here is a link to the 7 page text of this Initiative.

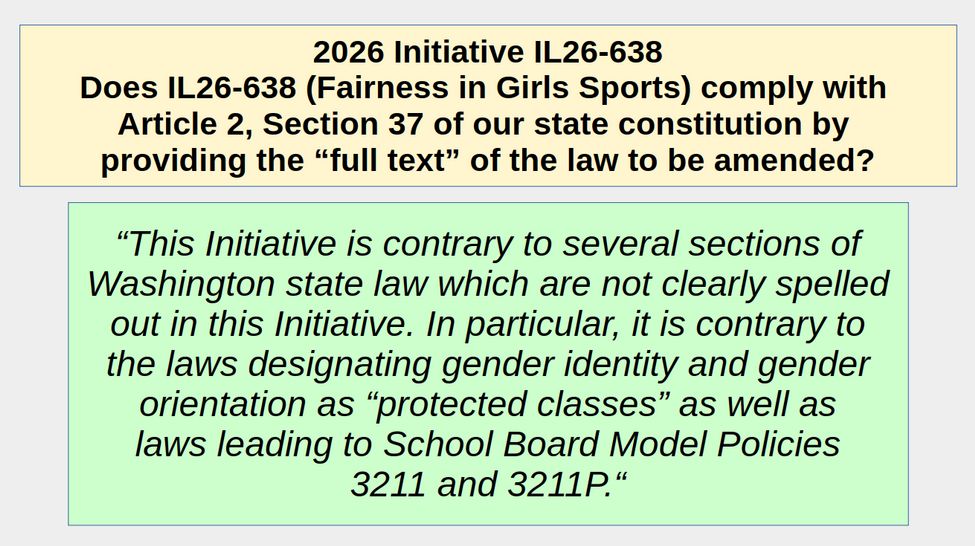

The Initiative is contrary to several other sections of Washington state law which are not clearly spelled out in this Initiative. In particular, it is contrary to the laws designating gender identity and gender orientation as protected classes as well as laws leading to School Board Model Policies 3211 and 3211P. Again, Article 2, Section 37 of the Washington constitution also known as the Full Text rule states:

"No act shall ever be revised or amended by mere reference to its title, but the act revised or the section amended shall be set forth at full length."

This means that the full text of EVERY law being revised or amended by the Initiative must be included in the Initiative submitted to the Secretary of State and must be printed in full on the back of every petition. Failing to include the full text of the law or section of law being amended can lead to the initiative being overturned.

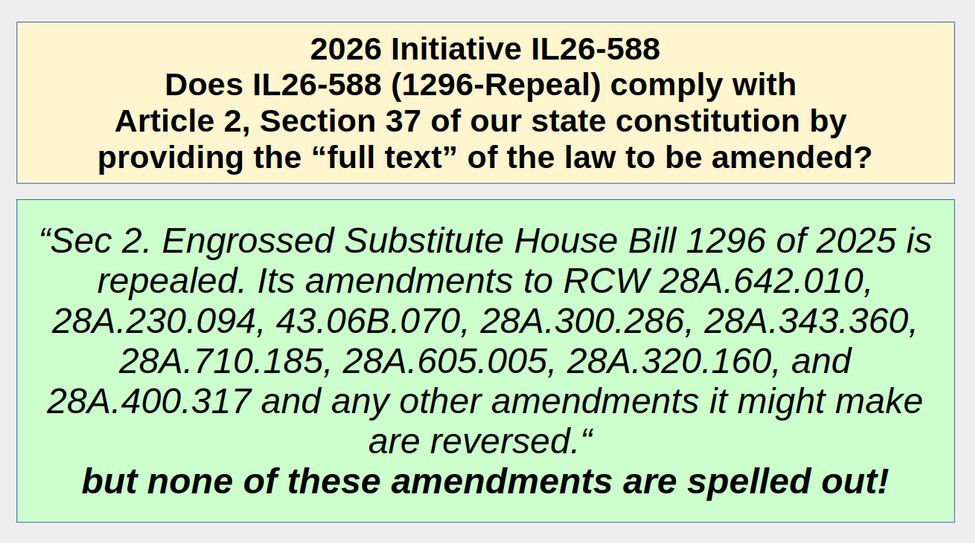

On July 3, 2025, Heywood submitted a new Initiative to the Legislature titled “1296-Repeal."

Here is a link to the text of this 3 page Initiative.

Section 1 is an Intent section which has no problems However, Section 2 appears to have several serious problems. Section 2 reads:

Sec 2. Engrossed Substitute House Bill 1296 of 2025 is repealed. Its amendments to RCW 28A.642.010, 28A.230.094, 43.06B.070, 28A.300.286, 28A.343.360, 28A.710.185, 28A.605.005, 28A.320.160, and 28A.400.317 and any other amendments it might make are reversed. Its new sections added to chapters 28A.320 RCW, 28A.642 RCW, 28A.230 RCW, 28A.300 RCW, 28A.410 RCW, 28A.710 RCW, 28A.715 RCW, and 28A.400 RCW and any other new sections it might create are removed.

Compare Section 2 which includes repealing several amendments to various laws to the instructions on repealing laws and amendments to laws from the Office of the Code Reviser 87 page Bill Drafting Guide which can be downloaded from this link:

https://leg.wa.gov/media/b2gdjkne/2025-bill-drafting-guide.pdf

Here are quotes from the Bill Drafting Guide:

Repealing sections of RCW.

Cite the RCW section to be repealed, the section caption, and its session law history, from most current to original (see RCW 1.08.050). For example:

NEW SECTION. Sec. 1. RCW 43.88.120 (Revenue estimates) and 2000 2nd sp.s. c 4 s 13, 1991 c 358 s 3, 1987 c 502 s 6, 1984 c 138 s 10, 1981 c 270 s 8, 1973 1st ex.s. c 100 s 7, & 1965 c 8 s 43.88.120 are each repealed.

(c) Repealing more than one section of the RCW. Use subsection groupings, cite each RCW section to be repealed, the section caption, and its session law history, from most current to original. For example:

NEW SECTION. Sec. 1. The following acts or parts of acts are each repealed:

(1) RCW 70A.210.040 (Actions by municipalities validated) and 1975 c 6 s 4;

(2) RCW 70A.210.050 (Municipalities—Revenue bonds for pollution control facilities—Authorized—Construction—Sale, conditions—Form, terms) and 1983 c 167 s 174, 1975 c 6 s 3, & 1973 c 132 s 5;

(3) RCW 70A.210.060 (Proceeds of bonds are separate trust funds—Municipal treasurer, compensation) and 1975 c 6 s 2; and (4) 2002 c 301 s 1 (uncodified).

NEW SECTION. Sec. 2. The following acts or parts of acts are each repealed:

(1) RCW 3.20.130 (Venue, criminal actions—Justice of the peace districts) and 1951 c 156 s 16; and

(2) RCW 3.20.131 (Venue in criminal actions) and 1953 c 206 s 4.

(END OF QUOTE)

The first problem with Heywood’s Section 2 is that the session law history to the various RCW being repealed are not specified. It would not take long to look up and add the session law history. But the bigger problem is that while entire laws can be repealed by reference to their RCW and session law, amendments to laws or sections of laws can not be repealed without full reference to the law or section of law being amended. This is why each of the amendments in House Bill 1296 included the complete text of the RCW section being amended.

Here is a quote on this section of our State Constitution as written by the Code Reviser:

“Amending without setting forth in full—Amendments to sections by reference.

Article II, Section 37 of the Washington state Constitution provides, "No act shall ever be revised or amended by mere reference to its title, but the act revised or the section amended shall be set forth at full length."

The purpose of this constitutional provision is to inform the legislature and the public as to the nature and effect of proposed and enacted statutes. It is not intended to restrict or hamper the legislature, but to regulate the method of enactment.

This is an example of amending a section by mere reference:

NEW SECTION. Sec. 1. A new section is added to chapter 43.21A RCW to read as follows: Notwithstanding the provisions of RCW 15.54.480, fertilizer inspection fees must be deposited into the water quality account

“Generally, this requirement does not apply to supplemental acts that do not modify or alter the original act in any way, to acts that merely add new sections to an existing act, or to acts complete in themselves, not purporting to be amendatory, but that by implication amend other legislation on the same subject. On the other hand, the courts are equally emphatic that if an act is not complete in itself and is clearly amendatory of a former statute, it falls within the constitutional inhibition whether it purports on its face to be amendatory or an independent act.”

(END OF QUOTE)

The Code Reviser and several rulings by the Washington State Supreme Court make it clear that Article II, Section 37 of our State Constitution will be strictly enforced. I therefore believe that Heywood’s July 3 Initiative would be ruled unconstitutional.

How to Make Sure that an Initiative complies with the State Constitution

The solution to all of these problems is to have Initiatives written by a committee to assure compliance with all of the provisions of the Washington State Constitution.

The Family Rights Initiative uses a broad title and addresses the same topics as House Bill 1296 – but in a way that actually protects the rights of students and parents. The Family Rights Initiative clarifies and broadens the rights of all family members including the rights of students and parents. Like House Bill 1296, the Family Rights Initiative also clarifies the rights and responsibilities of teachers and school board members – because the actions of both teachers and school board members can infringe on the rights of students and parents. In short, nearly anything that happens at school can be related to student and parent rights and therefore the Family Rights Initiative complies with the single subject rule – as long as the full title specifies that the Initiative broadens and clarifies the rights of students, parents, teachers and school board members. Folks are then alerted that if they want to know how these rights are clarified, they should read the actual text of the Initiative.

Our Family Rights Initiative is carefully written to comply not only with the “single subject” provision of the Washington State Constitution, but also to comply with the guidance of the Washington Supreme Court on how they determine whether an Act of the Legislature or Initiative to the People complies with the Single Subject Rule.

As always, I look forward to your questions and comments.

Regards,

David Spring M. Ed. Director,

Washington Parents Network